Can a Loan EMI Calculator Be Your Financial Fortune Teller?

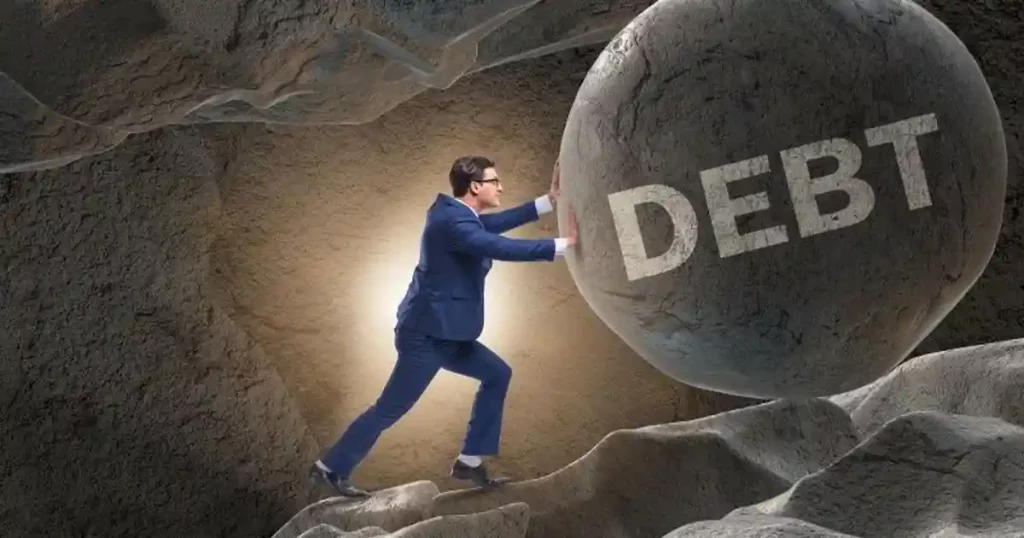

Making informed decisions is crucial for ensuring a stable and secure financial future. One such decision that many individuals face at some point in their lives is taking out a personal loan. Whether it’s for buying a home or a car or for personal reasons, understanding the financial implications of a personal loan is essential. This is where a Loan EMI (Equated Monthly Instalment) calculator steps in. The calculator offers a glimpse into borrowers’ financial future by helping them predict and plan for borrowing costs.

The following sections will explore the meaning and utility of the loan EMI calculator. Some tips to maximise the benefits of the calculator will also be shared. Read ahead to know more.

Understanding Loan EMI Calculator

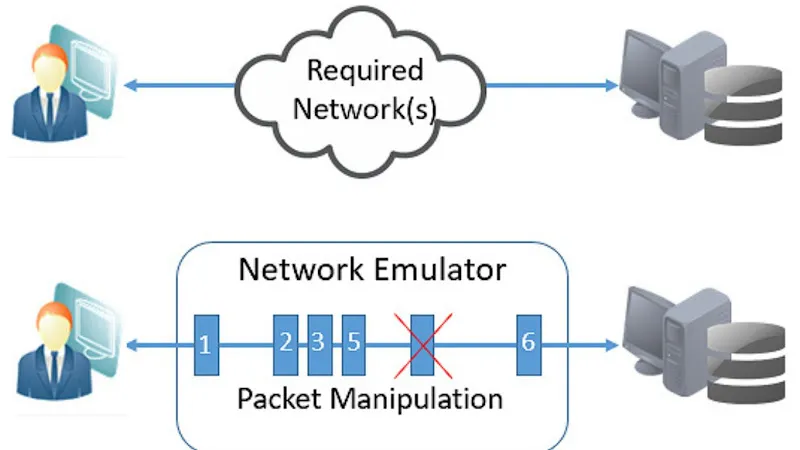

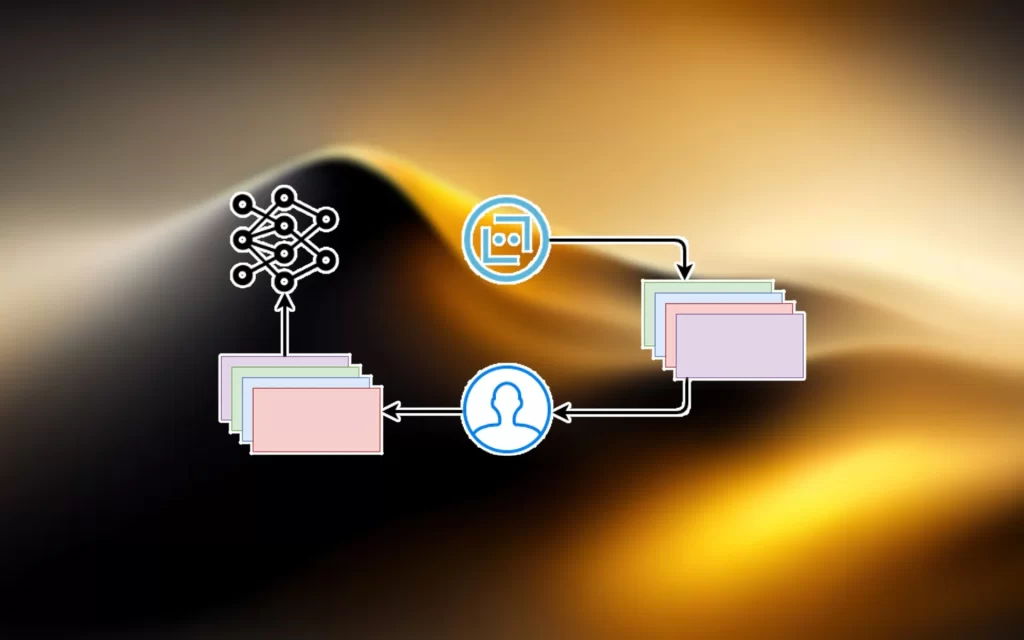

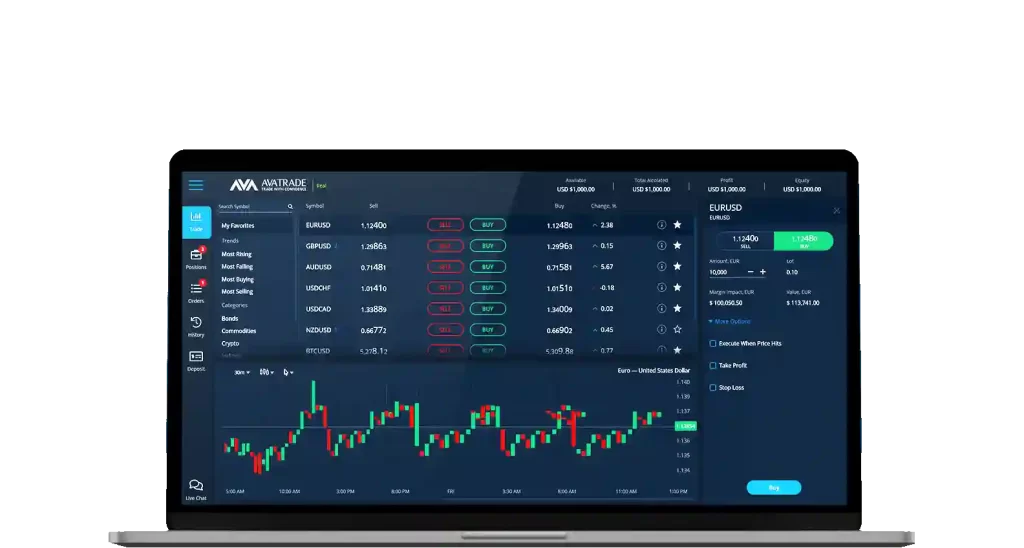

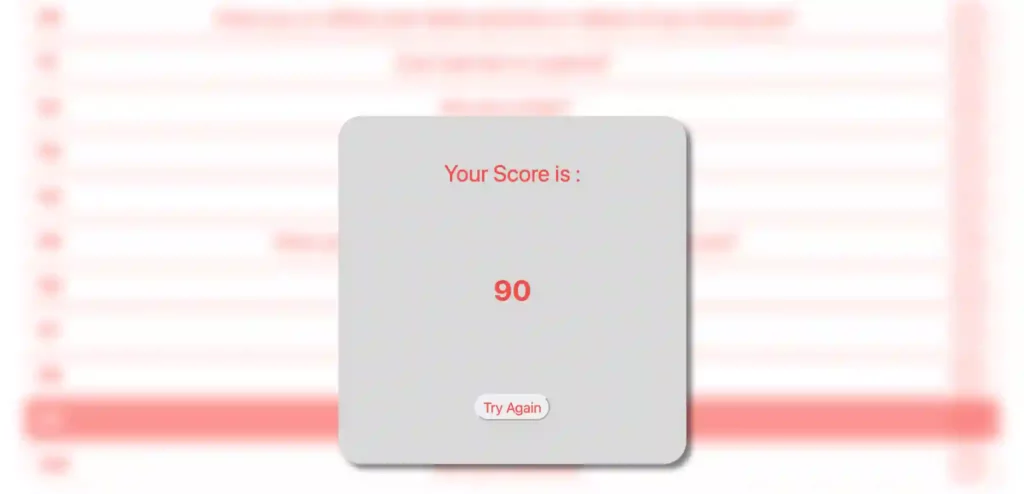

A loan EMI calculator is a simple online tool that allows individuals to estimate their monthly loan repayments. These calculators are widely available online. Users enter key variables such as the loan amount, interest rate, and tenure. The calculator then provides an instant breakdown of the monthly EMI.

Components of a Loan EMI Calculator:

- Loan Amount: The principal amount borrowed.

- Interest Rate: The rate at which interest is charged on the loan amount.

- Loan Tenure: The duration (months/years) for which the loan is taken.

- EMI: Fixed monthly payment, including both principal and interest.

- Total Interest Payable: The cumulative interest paid over the entire loan tenure.

- Total Repayment Amount: The total amount repaid by the borrower.

Advantages of Using a Loan EMI Calculator

Borrowers can address the challenges of loan management with confidence by leveraging the following advantages of the loan EMI calculator:

- Financial Planning and Budgeting

Loan EMI calculators lead to effective financial planning. By entering the loan amount, interest rate, and tenure, individuals can obtain a clear picture of the monthly EMI. This insight empowers them to evaluate whether the proposed EMI comfortably fits into their budget.

The calculator also helps in achieving financial discipline. Users can plan and organise their expenses in a way that accommodates the monthly EMI obligation. They can align their loan commitments with their income and prevent financial strain.

- Comparison of Loan Offers

The versatility of a loan EMI calculator becomes evident when individuals are exploring various loan options. By tweaking parameters such as loan amount, interest rate, and tenure, borrowers can easily compare multiple loan offers.

This feature is invaluable in decision-making. It enables users to select a loan with terms that best match their financial capacity. The ability to assess and compare different scenarios empowers borrowers to make informed choices.

- Quick Decision-Making

In today’s fast-paced world, making timely decisions is of utmost importance. A loan EMI calculator meets this need by providing instant and accurate results. Users can input the necessary details and receive EMI calculations on the spot. This eliminates the need for extensive manual computations or complex financial analysis.

This swift access to crucial information allows borrowers to act promptly and seize favourable loan opportunities.

- Risk Mitigation

The loan EMI calculator serves as a risk mitigation tool by providing a comprehensive view of the financial commitment.

Armed with this knowledge, borrowers can assess the feasibility of the loan in the context of their broader financial plan. They can ensure that the chosen loan terms align with their risk appetite and long-term objectives. This proactive risk management approach contributes to a more secure and resilient financial future.

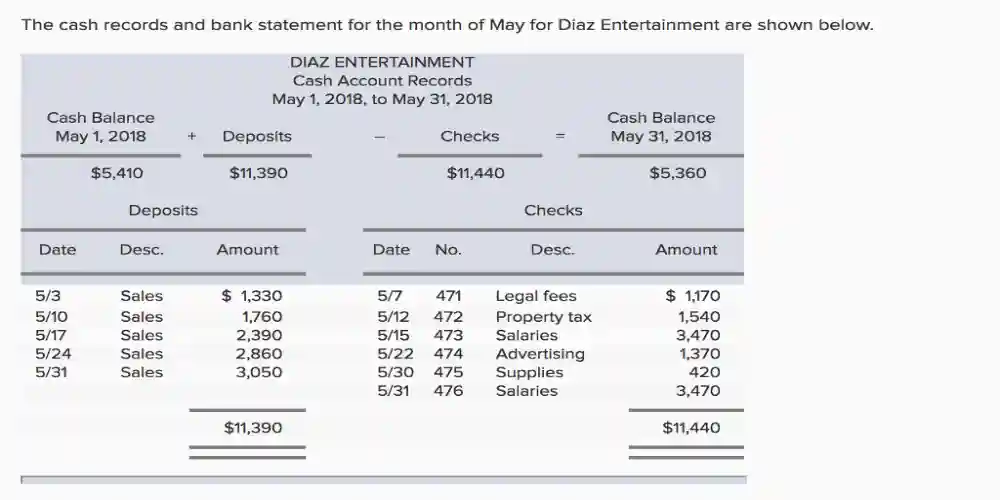

How is Loan EMI Calculated?

The calculation of loan EMI involves a systematic approach that takes into account the principal amount, interest rate, and loan tenure. The mathematical formula for calculating EMI is:

EMI= P×r×(1+r) n / (1+r)n – 1

Where:

- EMI refers to the Equated Monthly Instalment

- P refers to the principal or total loan amount

- r refers to the annual interest rate divided by 12

- n refers to the number of loan instalments

Tips for Using a Loan EMI Calculator

While a loan EMI calculator is a useful tool, maximising its potential requires a strategic approach. This section will provide practical tips for users to make the most out of their loan EMI calculator experience.

- Consideration of Additional Costs

While the primary focus of a loan EMI calculator is on estimating the monthly instalment, the borrowers should also consider additional costs associated with the loan. These may include processing fees and applicable taxes.

Failure to account for these supplementary expenses can lead to an underestimation of the actual financial commitment. By factoring in all associated costs, users gain a comprehensive understanding of the total expenditure involved in the loan.

- Regular Updates

Borrowers are advised to revisit the loan EMI calculator regularly, especially when there are alterations in income, expenses, or loan tenure. Life events such as a salary hike, change in employment, or unexpected financial windfalls can impact one’s ability to repay a loan comfortably.

Borrowers must also monitor market dynamics and stay informed about changes in policy rates. They must regularly update the calculator with the latest information. This can ensure financial stability in the face of economic fluctuations.

- Accuracy in Input

The accuracy of the loan EMI calculator’s output heavily relies on the precision of the entered data. Users must diligently enter the correct principal loan amount, interest rate, and loan tenure. Even a minor discrepancy can lead to significant variations in the calculated EMI.

- Consultation with Financial Advisors

For individuals dealing with complex financial scenarios or considering significant loans, seeking professional advice is highly recommended. While a loan EMI calculator provides valuable insights, financial advisors can offer personalised guidance. They can help navigate complex financial situations, optimise loan structures, and provide strategic advice for long-term financial planning.

Take Control of Your Financial Future with Loan EMI Calculator

Tools like the loan EMI calculator act as invaluable guides and provide clarity to users. They empower borrowers to take control of their financial destinies by highlighting the future implications of their choices. Borrowers can then make sound decisions that contribute to a stable and prosperous financial future.

Now, the question arises: where can one access the calculator? The good news is that the top personal loan platforms like KreditBee provide this tool on their websites. Thus, KreditBee is an excellent option for borrowers who prioritise convenience, quick disbursal of funds, and certainty regarding EMIs. Visit their website for more information and enjoy a 100% online, hassle-free personal loan application process!