How Probate Fees in NSW Affect Estate Settlement: Key Considerations

Probate fees in New South Wales (NSW) are crucial in the estate settlement process. Understanding these fees and their impact is essential for anyone administering an estate. This blog post will explore the key considerations surrounding probate fees in NSW and how they can affect the overall estate settlement. Whether you’re an executor, beneficiary, or simply interested in the topic, read on to gain valuable insights into the financial aspects of probate in NSW.

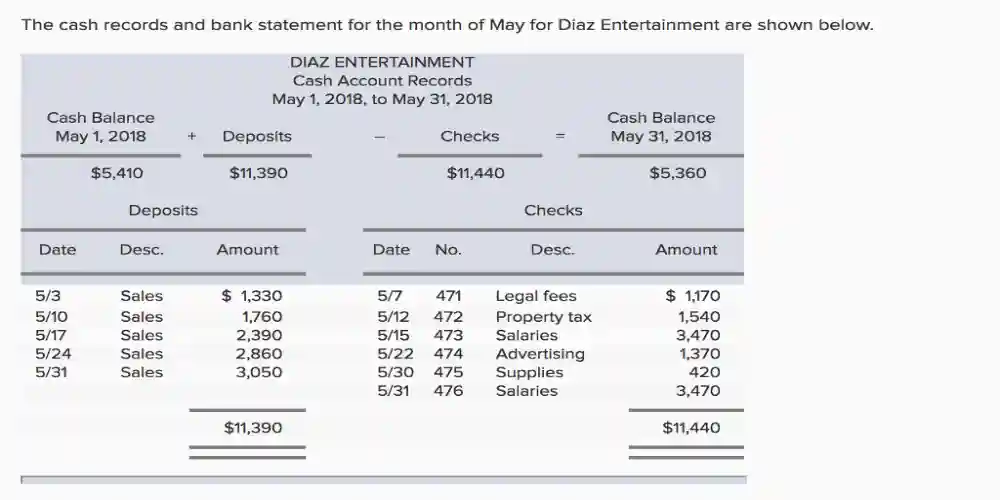

Probate Fees in NSW: An Overview

Probate fees in NSW are essential costs associated with obtaining a grant of probate from the Supreme Court. This legal document grants authority to the appointed executor to administer the deceased person’s estate. The fees are imposed based on the estate’s value and are intended to cover the administrative expenses incurred by the court during the probate process.

Fee Structure and Calculation

The size of the estate determines the fee structure for probate in NSW. The Supreme Court charges fees on a sliding scale, where larger estates attract higher fees. The fees are typically calculated based on the estate’s net value, which takes into account the total value of the assets minus any debts or liabilities. Executors and administrators need to familiarize themselves with the current fee schedule the Supreme Court provides to estimate the potential costs accurately.

Factors Influencing Probate Fees

Several factors can influence the final probate fees in NSW. The complexity of the estate is a significant consideration. Estates with intricate asset structures, multiple beneficiaries, or contentious issues may require more extensive legal involvement, leading to higher fees. The types of assets involved can also affect the fees, as certain assets may require additional valuations or specialized expertise. Additionally, if the deceased owned property in multiple jurisdictions, additional fees may be involved for ancillary probate grants.

Impact on Estate Settlement

Probate fees can considerably impact the overall settlement of an estate. The fees are typically paid from the estate’s assets, which can reduce the amount available for distribution to beneficiaries. Executors and administrators must carefully consider the potential fees when planning the estate’s financial affairs to ensure sufficient funds to cover these costs. Failing to account for probate fees adequately may result in delays, legal complications, or even the need to sell assets to cover the expenses.

Mitigating Probate Fees

While probate fees are a necessary part of the estate settlement process, there are strategies to mitigate their impact. Seeking professional advice from an estate planning lawyer or financial advisor can help identify opportunities to reduce the estate’s value or optimize its structure, ultimately leading to lower probate fees. For example, establishing trusts or gifting assets during one’s lifetime can minimize the estate’s overall value and potentially reduce the associated fees.

Alternatives to Probate

In certain situations, bypassing the probate process altogether may be possible, thereby avoiding probate fees. It can be achieved through various estate planning strategies. For instance, setting up assets with designated beneficiaries, such as life insurance policies or retirement accounts, allows them to pass directly to the beneficiaries without going through probate. Creating joint ownership or establishing a living trust can also be effective alternatives. Exploring these options with the guidance of an estate planning professional can help determine whether they are suitable for your specific circumstances.

Timelines and Costs of Probate

Probate fees in NSW can also be influenced by the timelines involved in the probate process. The duration of probate of Will can vary depending on the complexity of the estate, any legal challenges or disputes that arise, and the efficiency of the executor’s administration. It’s important to note that the longer the probate process takes, the higher the overall costs may be. Executors should streamline the administration process, promptly address legal issues, and efficiently distribute assets to minimize expenses associated with extended probate proceedings.

Professional Fees and Services

In addition to the probate fees charged by the Supreme Court, other professional fees and services may be required during the estate settlement process. Executors often engage the services of legal professionals, accountants, and valuers to assist with various aspects of probate. These professionals charge their fees, which can contribute to the overall estate settlement costs. Executors should consider these additional expenses when budgeting for probate of Will and seek professional quotes or estimates to ensure transparency and manage expectations.

Estate Planning and Probate Fees

Effective estate planning can significantly impact minimizing probate fees in NSW. Individuals can structure their assets to pass outside of probate by engaging in thoughtful estate planning strategies. It can include establishing joint ownership with the right of survivorship, designating beneficiaries on certain assets, or creating revocable living trusts. Proper estate planning reduces the value of the estate subject to probate and helps streamline the settlement process, potentially resulting in cost savings.

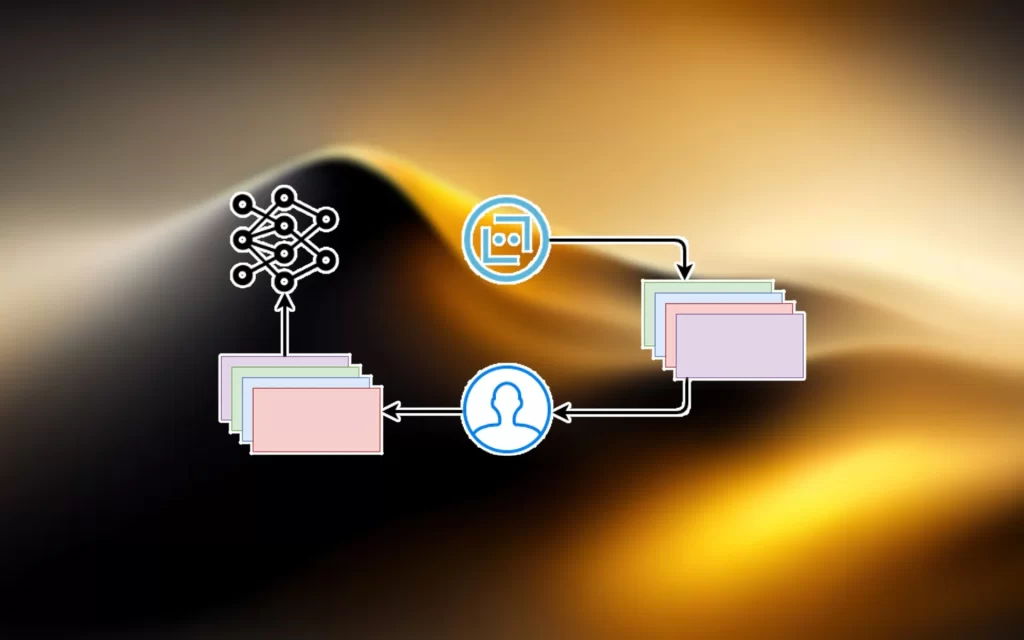

The Role of Executor Remuneration

Executors receive remuneration for their services in administering the estate. In NSW, the Supreme Court provides guidelines for determining executor remuneration based on the size and complexity of the estate. It’s important to note that the executor’s remuneration is separate from the probate fees and should be carefully considered when assessing the overall estate settlement costs. Executors should familiarize themselves with the court’s guidelines and seek professional advice to ensure their remuneration is fair and in line with legal requirements.

Conclusion

Probate fees in NSW are a crucial consideration when settling an estate. Understanding the fee structure, calculating potential costs, and exploring ways to mitigate or avoid these fees can significantly impact the distribution of assets to beneficiaries. Executors and administrators should carefully evaluate the financial implications of probate fees to ensure efficient and cost-effective estate settlement. Seeking professional advice from reputable companies like Probate Consultants can help navigate the complexities of probate and optimize the financial outcome for all parties involved.