Understanding the Insurance Coverage You Need for Your 5 Seater SUV

Do you know what insurance coverage your 5 seater SUV needs? Choosing insurance can be tricky. You want to protect your car, yourself, and your family without paying for extras you don’t need.

This article helps break down the essentials of insurance for your 5 seater SUV. We’ll guide you through what types of coverage are important and how to make informed decisions.

Whether it’s your daily commute, family road trips, or just running errands, we’ve got you covered.

Liability Coverage

Liability coverage is very important for your car insurance. It helps pay for damage or injuries you may cause to others in an accident. This is a must-have because it protects you against the financial burden of an accident that is your fault.

Most states require you to have a minimum amount of liability coverage. Remember, the more coverage you have, the more protection you have in case of an accident.

Collision Coverage

Collision coverage is for when your car hits another car or object, like a tree or a pole. It helps pay for the repairs to your SUV. This kind of insurance is useful because it can get your vehicle back on the road quickly after an accident.

Choosing to add collision coverage means you’re looking out for your car’s condition and your wallet. If you’re in an accident, you won’t have to pay all the repair costs yourself.

Comprehensive Insurance Coverage

Comprehensive coverage is there to help when unexpected things happen to your car that aren’t about crashing into something. This includes things like if a tree falls on your car if it gets stolen, or if it is damaged by a flood. It’s all about protecting your SUV from the kinds of risks that can happen when it’s parked or when you’re not even near it.

If you reside in North Carolina’s Piedmont Triad region and frequently encounter severe weather or wildlife hazards, comprehensive coverage from a reputable insurer like North Carolina’s Piedmont Triad Insurance can provide essential protection for your SUV.

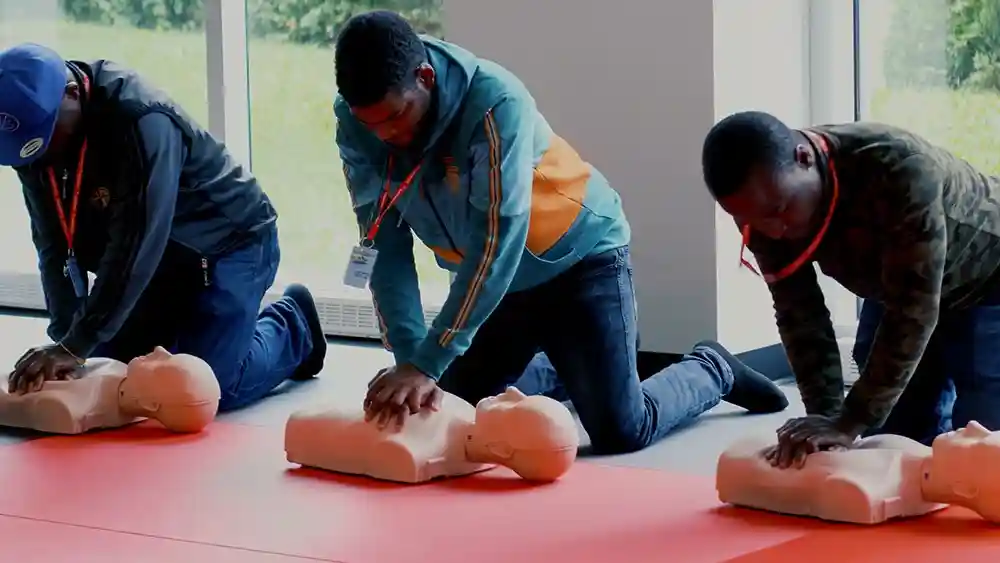

Medical Payments Coverage and Personal Injury Protection

Medical Payments Coverage, or MedPay, helps cover medical expenses for you and your passengers after an accident, regardless of who is at fault. This coverage can pay for hospital visits, doctor’s bills, and other medical treatments needed after an accident. It’s a way to ensure that medical bills do not become a heavy burden after an unforeseen event.

Personal Injury Protection, or PIP, is similar but provides broader coverage, including lost wages and rehabilitation costs. PIP is required in some states, offering a layer of financial protection that goes beyond medical treatment to help with the economic impact of being injured in an accident.

Secure Your 5 Seater SUV with the Right Coverage

Choosing the right insurance for your 5 seater SUV doesn’t have to be complicated. By understanding the basics we’ve outlined, like liability, collision, comprehensive, and medical coverage, you’re well on your way.

Each type provides specific protection, so consider what fits your driving habits and lifestyle best. It’s about keeping you, your family, and your SUV safe on every journey.

Did you learn something new from this article? If so, be sure to check out our blog for more educational content.