Tips for Choosing the Right Warranty for Your Vehicle

When purchasing a vehicle, one critical aspect often overlooked is the choice of warranty. This safety net can save you from future unforeseen costs and provide peace of mind. With so many options and details to consider, selecting the right warranty can be as important as choosing the vehicle itself. Below, you’ll find comprehensive guidance to help you make an informed decision. Keep reading to navigate the nuances of vehicle warranties and ensure you select the one that aligns best with your needs.

Understanding the Types of Vehicle Warranties

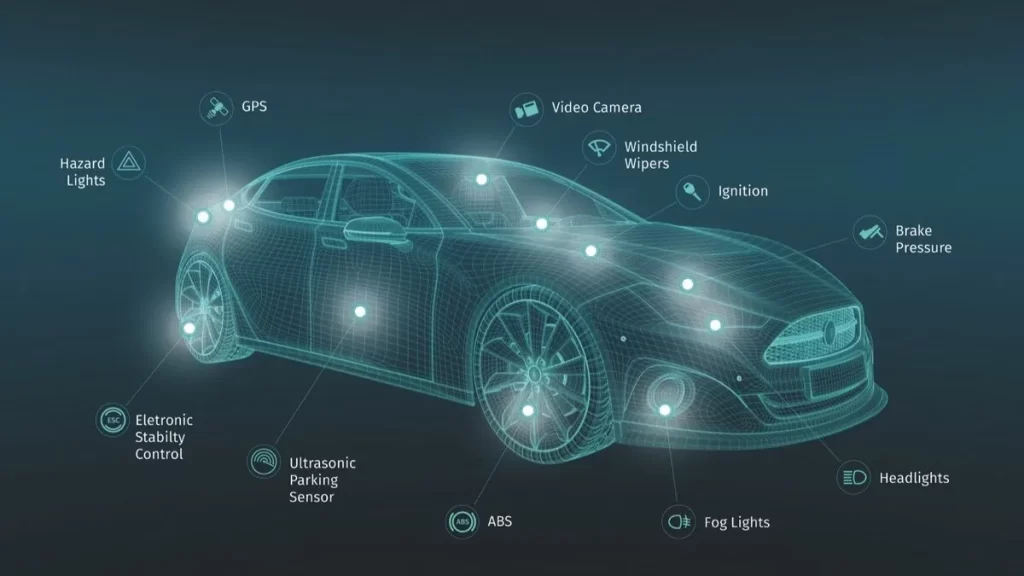

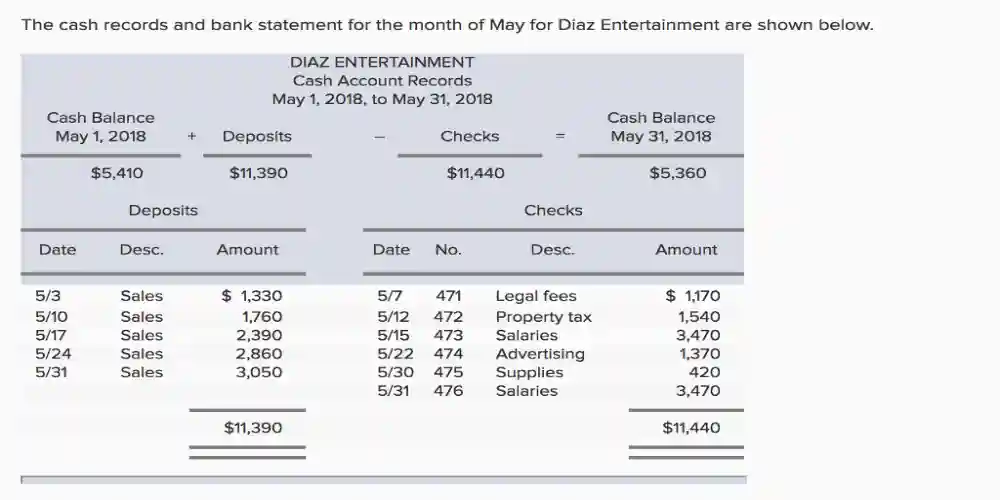

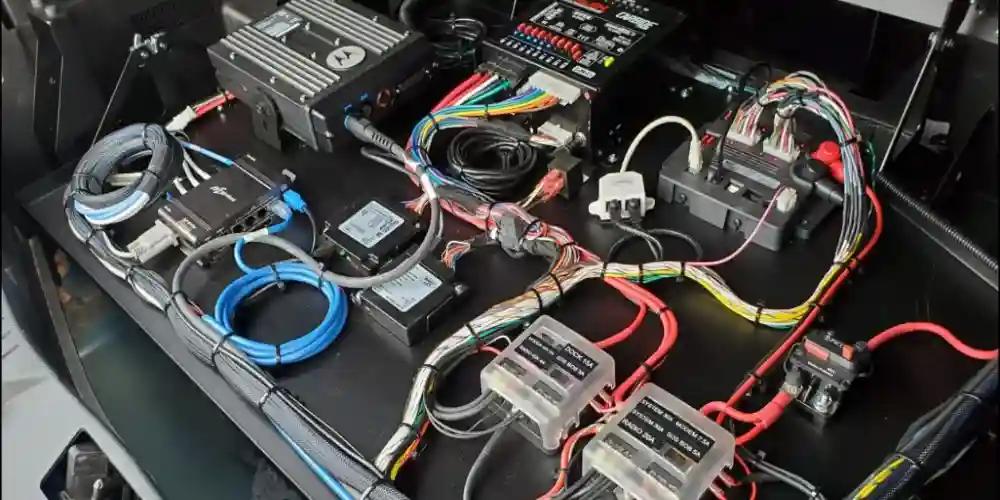

Vehicle warranties come in various forms, each offering different levels of protection. Manufacturers’ warranties, typically factory warranties, come standard with new vehicles and cover most parts and systems. However, they have a time and mileage limit, after which they expire. On the other hand, extended warranties can supplement the factory warranty, covering your vehicle longer.

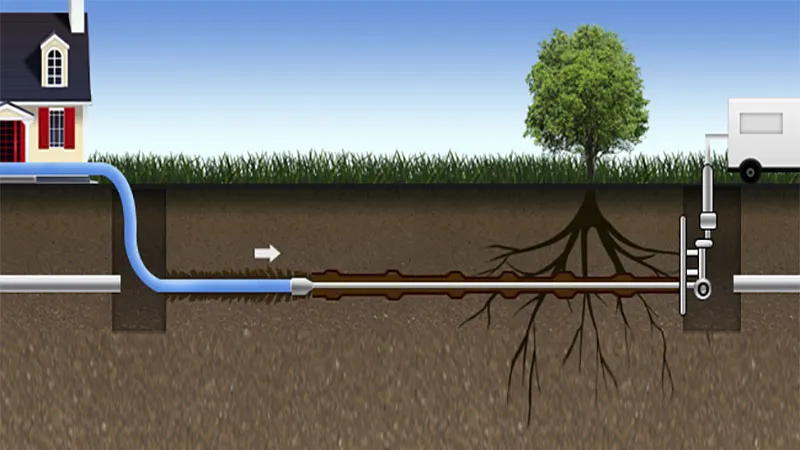

To distinguish between warranties, one should understand terms like “bumper-to-bumper,” which provides comprehensive coverage, and “powertrain,” which focuses on the engine, transmission, and other vital components. These terms help identify what is included in the coverage and guide you in choosing a warranty that suits your vehicle.

An example of a specific type of coverage can be seen with companies like Ford, which offer tailored warranties on certain aspects of their vehicles. A detailed overview of such a warranty, like the Ford Powertrain Warranty, can be accessed here, providing insight into the specifics that might be included in manufacturer coverage.

In addition to new vehicle warranties, used cars might come with their warranties or have the option for extended service plans. It’s vital to know what kind of coverage a pre-owned vehicle may have and how you might augment it with additional protection plans.

Assessing Your Vehicle’s Warranty Needs

Consider your driving habits and how they might influence the type of warranty you choose. An extended warranty might make more sense for those who drive frequently or cover long distances. It could provide broader coverage over an extended period, ensuring that heavy usage doesn’t leave you vulnerable to costly repairs.

The age and condition of the vehicle play a pivotal role in determining warranty needs. A newer vehicle may not require an extensive warranty beyond the factory coverage, while an older car might benefit from additional protection to cover potential part failures and maintenance issues.

It’s also essential to consider your financial comfort when handling repairs without warranty coverage. If unexpected repair costs could significantly affect your budget, seeking a robust warranty could mitigate the risk of unexpected expenses. On the other hand, if you have a contingency fund that can handle potential repairs, you may opt for more limited coverage.

Lastly, look at your long-term ownership plans. If you tend to change vehicles every few years, long-term warranties may not offer the most value. Conversely, securing a long-term warranty could safeguard against aging vehicles’ costs if you plan to keep your car for many years.

Evaluating Cost Versus Coverage Benefits

A warranty’s price is significant but must be weighed against the benefits. An expensive warranty that covers nearly every scenario offers little comfort if it’s financially burdensome. Conversely, a cost-effective warranty that provides scant coverage may cost more if it doesn’t cover necessary repairs in the long run.

Consider the deductible and how it fits into your financial situation. A higher deductible might result in a lower overall warranty cost, but ensure you can afford the out-of-pocket expense in case of a claim. Similarly, a low deductible plan may offer less worry at the time of repair but come with higher upfront or monthly costs.

Consider the potential resale value of your vehicle with a transferable warranty. Such a warranty could make your car more attractive to future buyers, yielding a higher sale price. It’s an often-overlooked aspect that can provide financial benefits down the road.

Finally, calculate the potential costs of common repairs for your vehicle model without a warranty and compare them with the warranty price over time. This comparison can help you decide whether the investment in a warranty is likely to pay off in your specific circumstances.

Overall, choosing the right warranty for your vehicle is crucial for financial security and peace of mind. By understanding the types of warranties available, assessing your driving habits and vehicle’s condition, and evaluating cost versus coverage benefits, you can make an informed decision tailored to your needs. Remember to consider long-term ownership plans and potential resale value, ensuring that your selected warranty aligns with your current situation and future aspirations.